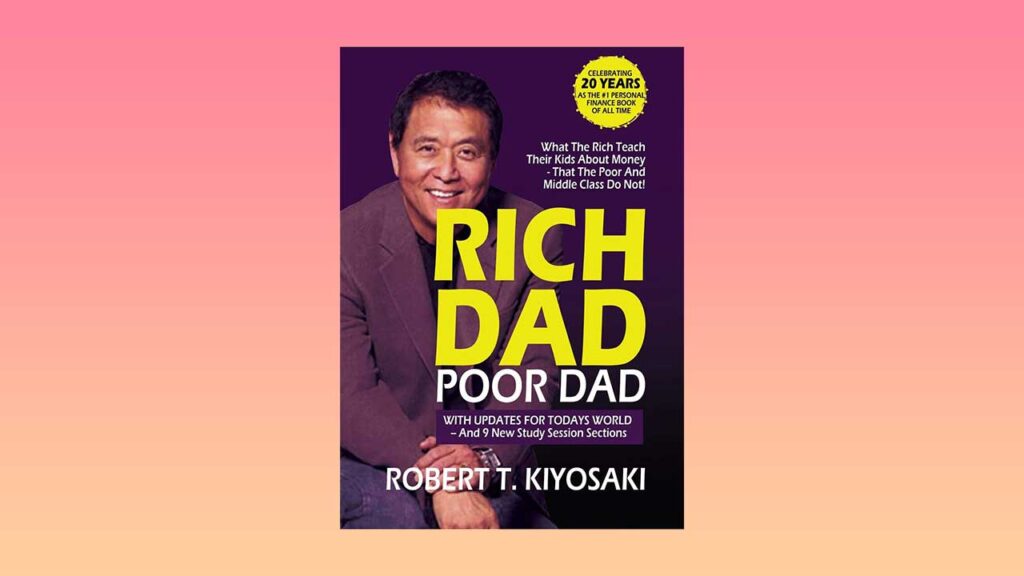

Rich Dad Poor Dad PDF by Robert Kiyosaki first caused a stir in the personal finance industry around 25 years ago. Since then, it has risen to the position of being the best-selling personal finance book of all time and has been published worldwide. The book Download Rich Dad Poor Dad tells Robert’s tale of growing up with two fathers: his real father and the wealthy father of his best friend, and how both of them influenced the way Robert views money and investing. The book debunks the fallacy that having a large salary is a prerequisite for wealth and outlines the distinction between working for money and having your money work for you.

Rich Dad Poor Dad PDF – Short Review

Rich Dad Poor Dad Free Download is a book written by Robert Kiyosaki and Sharon Lechter. The book was first published in 1997 and has since become a bestseller, with over 32 million copies sold in more than 51 languages worldwide. The book aims to teach readers about financial literacy and how to attain financial freedom.

The book is structured as a memoir, where the author tells the story of his two dads. His “rich dad” was his best friend’s father, who was a successful businessman, and his “poor dad” was his own father, who was a highly educated but struggling government employee. Kiyosaki compares and contrasts these two fathers’ financial habits and philosophies throughout the book.

One of the central themes of the book is the importance of financial education. Kiyosaki argues that traditional education, such as school and college, does not provide students with the necessary financial literacy to succeed in the real world. He suggests that financial education should be taught early and that parents should be responsible for teaching their children about money management.

Another essential concept in the book is the difference between assets and liabilities. Robert Kiyosaki PDF argues that the rich acquire assets, such as real estate, stocks, and businesses, which generate income, while the poor acquire liabilities, such as cars, houses, and credit card debt, which drain their finances. He emphasizes that it is crucial to understand the difference between the two and to focus on acquiring assets.

Kiyosaki also stresses the importance of taking calculated risks and being open to new opportunities. He shares his own personal experiences of starting and growing businesses and highlights the benefits of being an entrepreneur. He believes that taking calculated risks can lead to financial success and encourages readers to step out of their comfort zones.

In addition, the book emphasizes the importance of financial independence and the need to create passive income streams. Kiyosaki explains that passive income is income that is earned without having to actively work for it, such as rental income or dividends from stocks. He argues that creating passive income streams is key to achieving financial freedom.

One of the most significant takeaways from the book is the importance of changing one’s mindset about money. Kiyosaki argues that many people have a negative attitude toward money, viewing it as a source of stress and anxiety rather than as a tool for creating wealth. He encourages readers to adopt a positive attitude towards money and to view it as a means to achieve their financial goals.

Also read: LIVING IN THE LIGHT PDF

Overall, “Rich Dad Poor Dad” is an excellent resource for anyone looking to improve their financial literacy and achieve financial freedom. The book is written in an easy-to-understand manner and is full of practical advice and examples. It emphasizes the importance of taking responsibility for one’s financial education and highlights the need to adopt a positive mindset toward money. I highly recommend this book to anyone looking to improve their financial situation and achieve financial freedom.

This Post Has One Comment